By: Alex Rivera

Navigating the world of cryptocurrency taxes can feel like walking through a minefield. With new regulations and guidance changing frequently, many crypto investors and traders find themselves confused about what they owe and how to report their earnings properly. If you’re asking questions like, “What is a cryptocurrency tax guide?” or “How to report crypto gains correctly?” you’re in the right place.

This guide breaks down the essentials you need to know to stay compliant, avoid penalties, and make tax season less stressful. We’ll cover the key concepts behind cryptocurrency taxation, how gains are calculated, reporting requirements, and tips to make the process smoother.

Understanding Cryptocurrency Taxes: What You Need to Know

First off, it’s important to understand that cryptocurrencies like Bitcoin, Ethereum, and others are treated as property for tax purposes in many countries, including the U.S. This means that every time you sell, trade, or use crypto, it can trigger a taxable event.

A solid cryptocurrency tax guide starts here: any time you dispose of your crypto, you may have to report gains or losses on your taxes. This can happen when you:

Each of these can create capital gains or losses based on the difference between your cost basis (what you paid) and the fair market value at the time of the transaction.

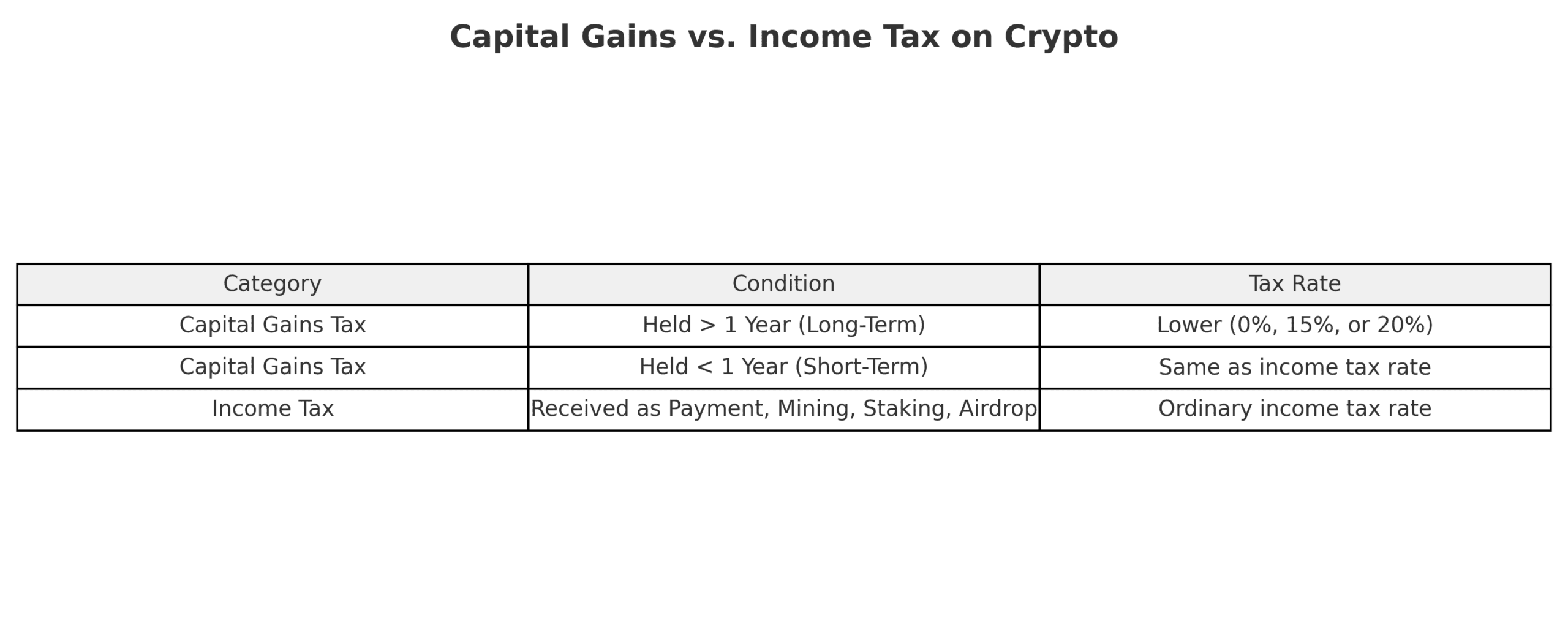

Capital Gains vs. Income Tax on Crypto

When figuring out your tax obligations, it helps to understand the difference between capital gains and income tax related to cryptocurrency.

-

Capital Gains Tax: This applies when you sell or trade crypto. If you held the asset for more than a year, you qualify for long-term capital gains tax rates, which are generally lower. Less than a year means short-term rates, which are the same as your ordinary income tax rate.

-

Income Tax: Sometimes you receive crypto as payment for services, mining rewards, staking, or airdrops. In these cases, the value of the cryptocurrency at receipt is considered income and taxed accordingly.

Your cryptocurrency tax guide should include both aspects since you may encounter one or both in your tax situation.

How to Calculate Your Crypto Gains and Losses

Calculating your gains and losses can get complicated if you’re an active trader or have multiple transactions. Here’s the basic formula:

Capital Gain (or Loss) = Fair Market Value at Sale/Trade – Cost Basis

-

Cost Basis is what you originally paid for the crypto, including fees.

-

Fair Market Value is the USD (or your local currency) value at the time you sold or traded it.

If you have multiple buys of the same cryptocurrency, you need to track which batch of coins you’re selling. The IRS allows several methods such as FIFO (first-in, first-out), LIFO (last-in, first-out), or Specific Identification if you keep detailed records.

How to Report Crypto Gains on Your Taxes

When it comes to how to report crypto gains, the process usually involves filling out specific forms along with your tax return.

IRS Form 8949 and Schedule D

In the U.S., capital gains and losses from cryptocurrency transactions are reported on Form 8949, which details each transaction, including date acquired, date sold, cost basis, proceeds, and gain or loss.

Then, totals from Form 8949 flow into Schedule D of your tax return, which summarizes your overall capital gains and losses for the year.

Reporting Income from Crypto

If you received crypto as income—say mining rewards or payment for services—this should be reported on your Form 1040 as income. The fair market value of the crypto at receipt becomes your taxable income amount.

Common Mistakes to Avoid When Reporting Crypto

Even with a solid cryptocurrency tax guide, mistakes happen. Here are common pitfalls to avoid:

-

Not reporting all transactions: Every taxable event needs reporting, even small trades or purchases.

-

Ignoring cost basis adjustments: Remember to include transaction fees in your cost basis.

-

Mixing up short-term and long-term gains: Holding periods impact your tax rate, so track dates carefully.

-

Failing to report crypto income: Mining, staking, and airdrops are income and must be declared.

-

Using inaccurate valuation: Use reliable sources for fair market value at transaction times.

Tools and Software to Simplify Crypto Tax Reporting

Doing your crypto taxes manually is tedious. Luckily, several tools can automate this process and generate tax reports:

-

CoinTracker: Syncs wallets and exchanges to calculate gains/losses and generate IRS forms.

-

Koinly: Popular for its user-friendly interface and support for many platforms.

-

CoinLedger: Easy import of transactions and report generation.

-

ZenLedger: Offers audit support and works well for frequent traders.

Using one of these tools is a smart move, especially if you have dozens or hundreds of transactions.

Staying Ahead of Crypto Tax Regulations

Crypto tax laws continue to evolve. Governments worldwide are increasing scrutiny on digital currencies to ensure proper reporting and tax collection.

To stay compliant:

-

Keep detailed records of every transaction—date, amount, cost basis, value in USD.

-

Use a reputable crypto tax tool for accuracy.

-

Stay updated on changes in tax regulations in your country.

-

Consider consulting a tax professional with crypto experience.

Wrapping Up Your Cryptocurrency Tax Guide

Understanding your tax obligations related to cryptocurrency doesn’t have to be overwhelming. With a clear plan and the right tools, you can confidently handle how to report crypto gains and stay on the right side of the law.

Remember, every sale, trade, or income event matters when it comes to taxes. Don’t wait until tax season to get your records in order. Start now by tracking transactions and using software that fits your needs.

Taking cryptocurrency taxation seriously protects you from penalties and ensures your crypto journey remains smooth and rewarding.

About the Author: Alex is a long-time journalist for NewsWatch, using his expertise to explain to readers how technology is reshaping society beyond mere gadgets and algorithms. His reporting cuts through industry hype to reveal the human stories behind technical innovations, offering readers a thoughtful perspective on where our digital future is heading.

Disclaimer:

The author’s views expressed in this article are those of the author and do not necessarily reflect the opinions of NewsWatchTV. This content is for informational purposes only and should not be considered financial or investment advice. Readers are strongly encouraged to conduct independent research and consult with a financial expert before making any investment decisions. NewsWatchTV is not responsible for the accuracy of the information provided or any losses or damages arising from reliance on this content.